Revenue Analytics & Jonas Chorum Launch Two-Way Integration for Hotels

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

With the world facing an unprecedented crisis, Covid-19 has made a huge impact on the global lodging industry. Since the first quarter of 2020, there have been widespread changes and adaptations. While some of them are meant to address issues in the short-term, others are here to stay.

As a part of the lodging industry, the Cloudbeds team wanted to understand the challenges being faced by our customers, and even the entire travel community. With the focus on lending valuable support and insights to hoteliers' recovery plans, we aimed at gathering critical information that could impact decision-making.

For this particular reason, we recently launched a sentiment survey to get feedback on how hosts and hoteliers around the world are anticipating reservation and travel trends to change in the coming months.

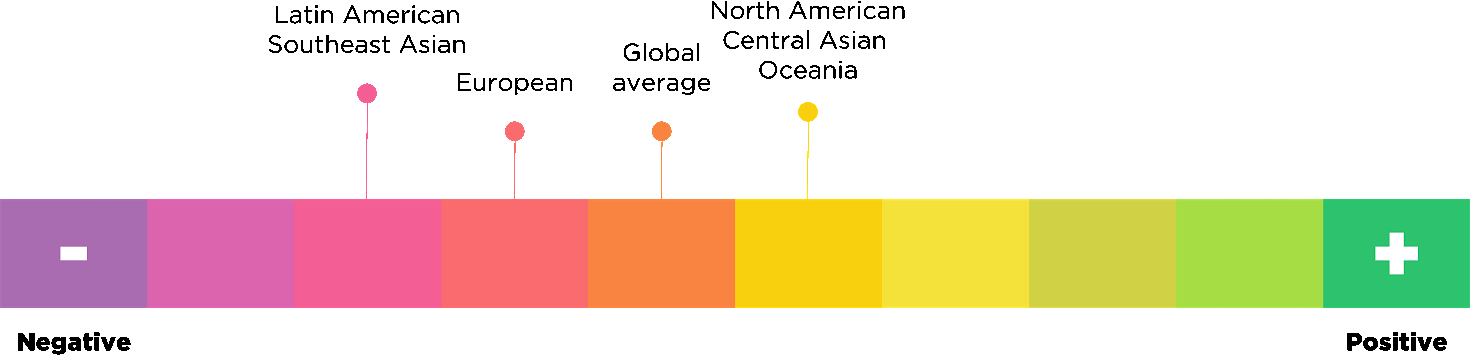

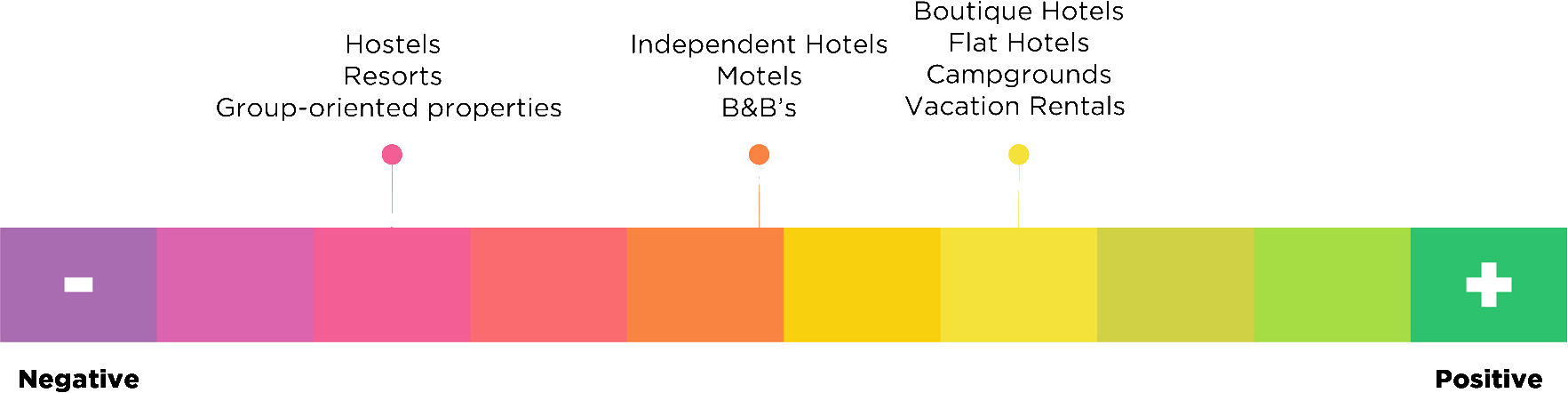

Over 1,000 independent owners and operators spread across 65 countries responded to the sentiment survey, allowing us to gather useful information regarding the community's feelings about the lodging industry. It also helped us understand the changing guest behaviour, and what we should expect in the coming year.

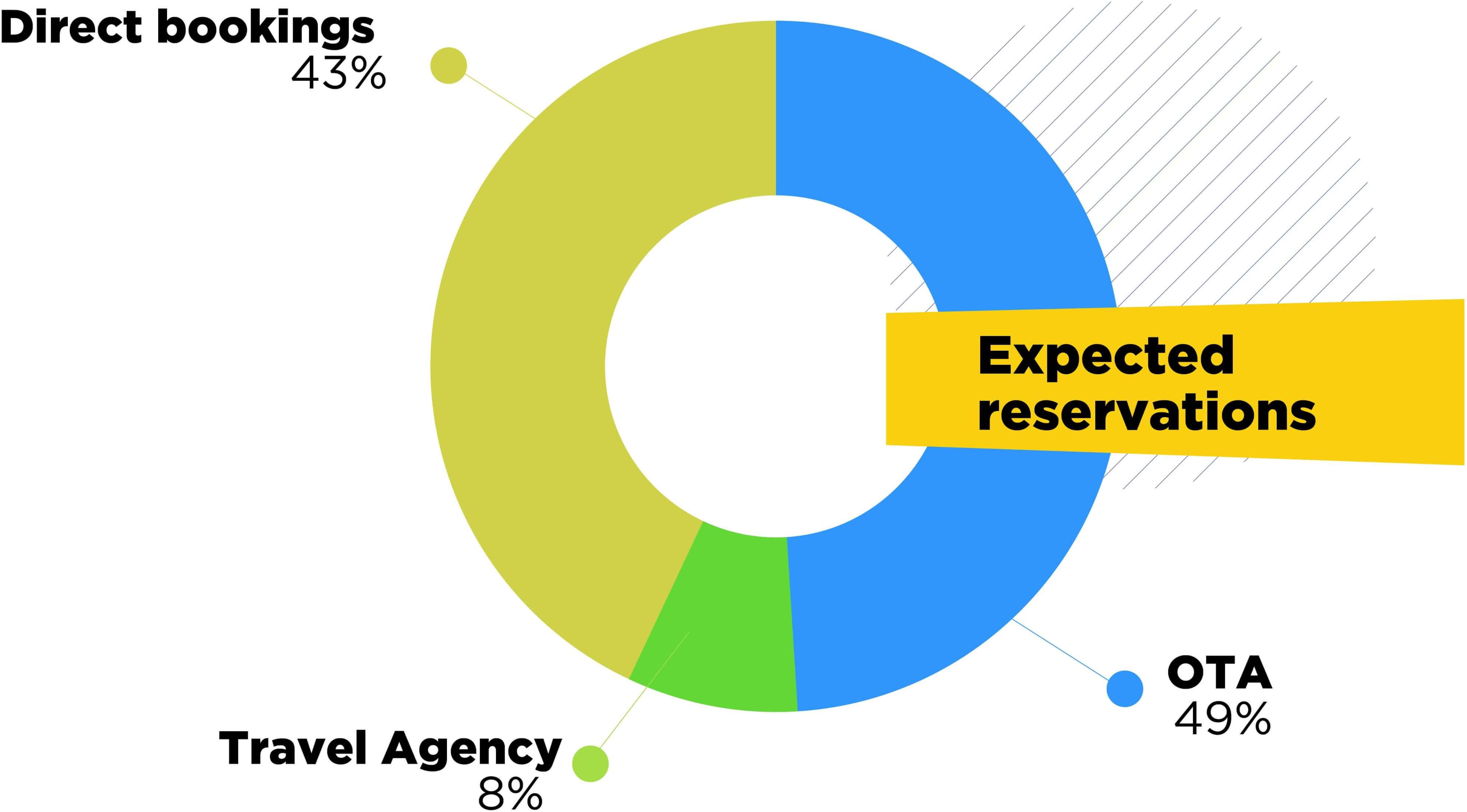

The sentiment survey focused on timely questions, which included everything from the timing of lockdown lifting to the predicted distribution of reservations. Let's take a look at the data we gathered to explore some of the most compelling and impactful findings.

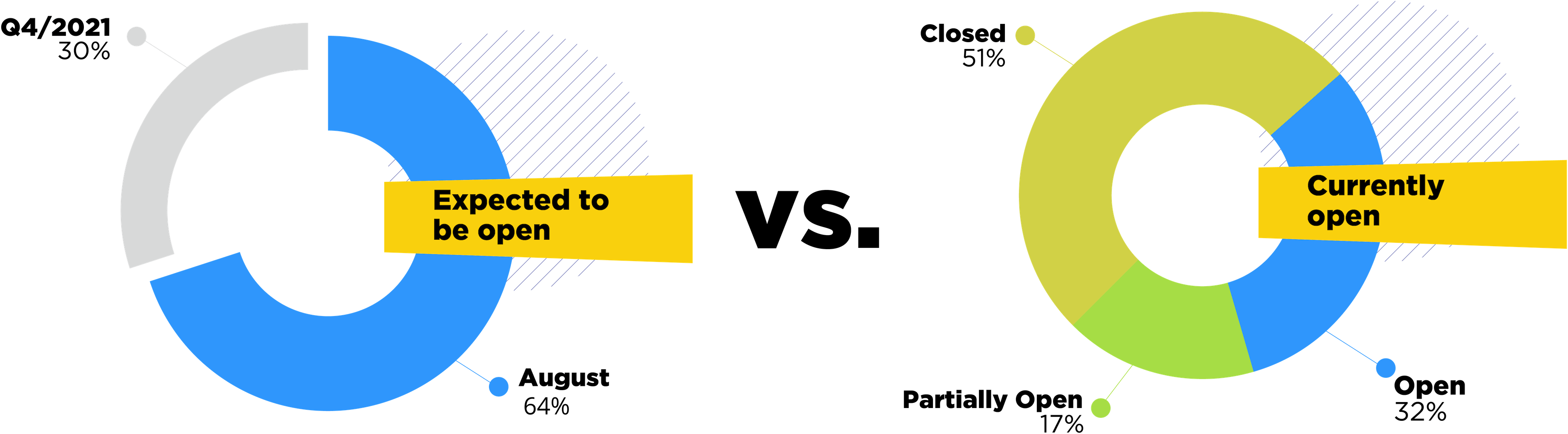

But before we dig deeper, let's share the gist of the information that we collected. With 64% of respondents expecting the lockdown to be fully lifted by late August, the third quarter of 2020 seems to be the launchpad for full-term recovery in the hospitality industry. Since only 32% of the respondents are currently open, this anticipated outcome indicates growing positivity around the lifting of restrictions.

When we asked customers to compare reservations in the pre and post-Covid era, the responses were consistent. Almost every hotelier expected the demand to follow a returning path over the next 18 months. With the growing optimism, some even suggested that the demand could exceed 2019 levels.

After analyzing the submitted responses, we've been able to pen down the following trends:

With HotelMinder, match with vetted hotel experts to solve your operational problems.

While Covid-19 subsides and the world opens to new opportunities, the hospitality industry will have to take some crucial steps regarding social distancing, safety, and health. With support from the community and insights that could impact decision-making, we're sure that business will be back to normal sooner than later.

In addition to this sentiment survey, we have released a robust market insights dashboard to help customers anticipate demand and plan for the future by observing occupancy, booking, and cancellation trends on a country-by-country basis.

Cloudbeds is hospitality's only intelligent growth engine — a unified platform trusted by the world's most ambitious hoteliers across 150 countries.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launched to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Browse Knowledge Hub

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.