In the hotel industry, understanding the true value of a property is essential for making informed financial decisions. Whether you're planning to buy, sell, or refinance, a proper valuation gives you insight into the financial worth of a hotel, helping owners and investors take strategic steps for profitability and growth. Hotel valuation consulting is a specialized service that provides expert assessments of a hotel’s market value based on its current operations, financial health, and market potential.

What is Hotel Valuation Consulting?

Hotel valuation consulting involves detailed analysis and evaluation of a hotel’s assets, revenue streams, operational performance, and market conditions to determine its overall value. This service is critical for hotel owners, investors, and developers looking to understand the financial landscape of their property, whether for sale, acquisition, or refinancing purposes.

Valuation consultants typically use various methods, including income capitalization, sales comparison, and cost approaches, to determine a hotel's worth.

Key Aspects of Hotel Valuation Consulting

1. Financial Performance Analysis

A hotel’s revenue, expenses, and profitability are the most critical factors in determining its value. Consultants review key financial metrics, such as:

- Gross Operating Profit (GOP): A measure of how well a hotel converts revenue into profit.

- RevPAR (Revenue Per Available Room): A KPI for revenue generated by the hotel’s available rooms.

- ADR (Average Daily Rate): Reflecting the average price of rooms sold, ADR is crucial in assessing a hotel’s earning potential.

These figures provide a foundation for assessing both the current and future earning potential of a property.

2. Market Position and Competitive Landscape

The valuation process also involves analyzing the hotel’s position within the local market. This includes:

- Competitive Set (CompSet) Analysis: A comparison of the hotel’s performance against direct competitors.

- Market Trends: Consultants evaluate the broader trends in the hospitality industry, including demand for rooms, occupancy rates, and economic factors impacting tourism.

Understanding the competitive landscape is vital for determining a realistic and accurate market value.

3. Property Condition and Capital Expenditures (CapEx)

The physical condition of the hotel also plays a significant role in its valuation. Consultants assess:

- Building Condition: How well-maintained the property is and whether major renovations or upgrades are needed.

- Capital Expenditures (CapEx) Requirements: Upcoming costs for major repairs or improvements that could impact long-term value.

A well-maintained property with minimal upcoming CapEx requirements is likely to have a higher valuation compared to one that requires significant investment.

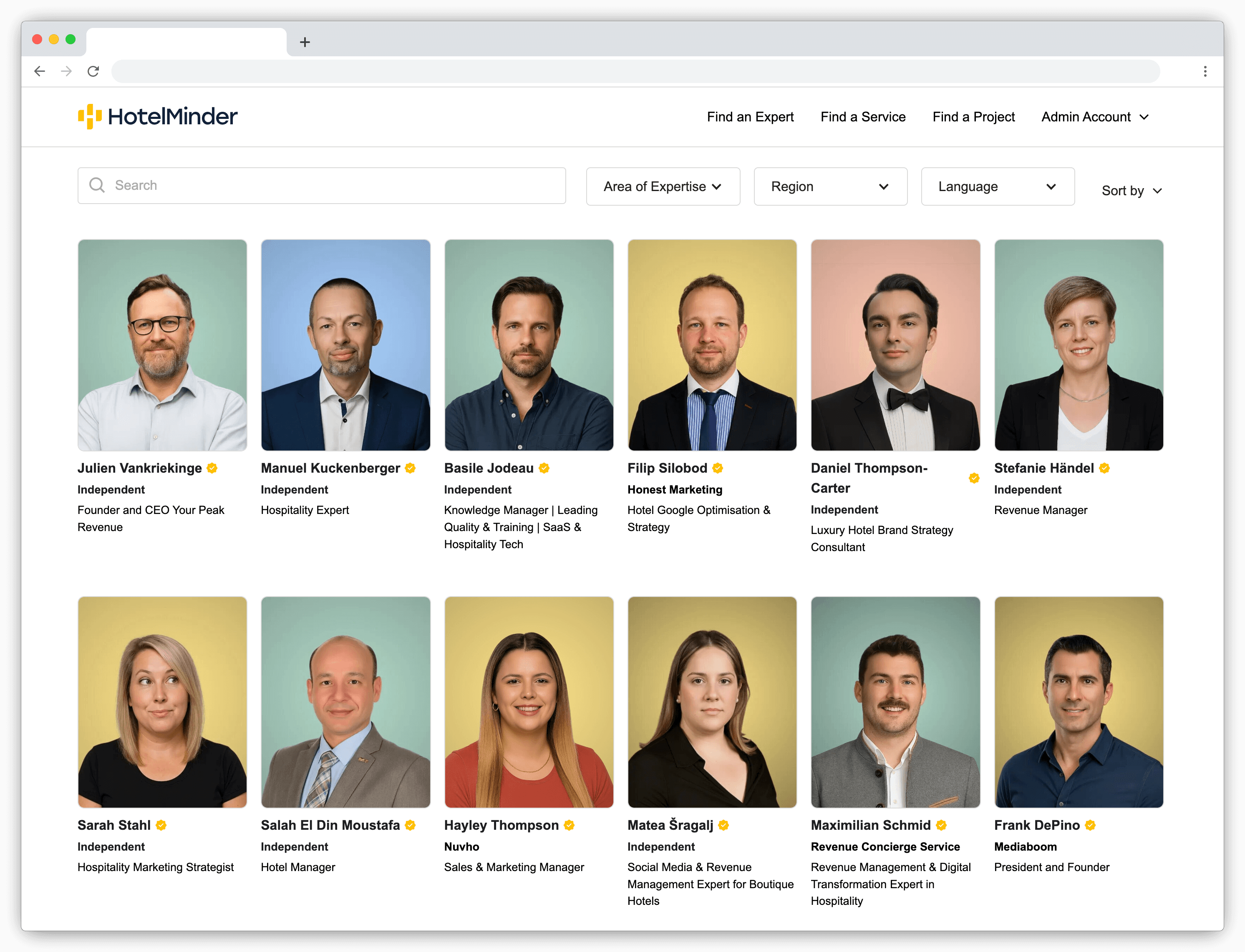

With HotelMinder, match with vetted hotel experts to solve your operational problems.

- Access specialists to boost occupancy, ADR & revenue.

- Effortlessly upgrade your technology and online presence.

- Quickly solve complex distribution and technology challenges.

4. Location and Real Estate Value

The location of a hotel heavily influences its valuation. Prime locations, especially in high-demand tourist or business districts, generally lead to higher market values. Consultants assess real estate factors, such as:

- Proximity to Attractions: Whether the hotel is located near tourist attractions, airports, or business centers.

- Future Development Potential: Any upcoming infrastructure projects or real estate developments in the area that could increase the property's value.

5. Operational Efficiency

Hotel valuation also considers how efficiently the hotel is run. Consultants review management strategies, operational workflows, and employee productivity to identify whether the property is being operated in a cost-effective manner. Hotels that are managed efficiently tend to have higher valuations due to their potential for maximizing profitability.

Why Hotel Valuation Consulting is Important

Whether you're an owner or an investor, understanding the full value of a hotel allows you to:

- Make Informed Decisions: Whether to buy, sell, or refinance, knowing a hotel’s true market value ensures you make strategic financial moves.

- Secure Financing: Lenders often require accurate valuations to assess loan applications for hotel acquisitions or refurbishments.

- Maximize Investment: By understanding a hotel’s current performance and future potential, owners can take action to enhance its value, whether through renovation, operational improvements, or market repositioning.

Beyond Valuation: The Role of Other Consulting Services

Hotel valuation consulting is often part of a broader suite of consulting services, including:

- Hotel Sales Consulting: Helps owners maximize returns when selling their property, utilizing the valuation data to market the hotel to potential buyers.

- Hotel Cost Analysis Consulting: Ensures the property operates as efficiently as possible, increasing profitability and value.

- Hotel Yield Management Consulting: Optimizes pricing strategies, boosting revenue and further enhancing the hotel's value.

Conclusion

Accurate and thorough hotel valuation is essential for any stakeholder looking to make the most out of their investment. By working with expert hotel valuation consultants, owners and investors can ensure they understand the true financial worth of their property, set realistic financial goals, and take strategic steps to increase long-term profitability and success in the competitive hospitality market.

Why HotelMinder?

There's no need to struggle with endless research or vetting to get an answer to your most pressing problems. HotelMinder eliminates the complexity of technology sourcing, directly connecting you with qualified experts and top tech vendors to help you resolve your hospitality challenges efficiently.

Instant Expert Matching: Tell us your hospitality challenge or project, and we'll personally match you with carefully vetted, specialized hospitality experts. Quick, precise, effortless.

Curated Network, Trusted Experts: We maintain close relationships with top hospitality specialists worldwide. Our experts are carefully selected for their proven capability in strategy, tech implementation, revenue management, hotel operations, marketing, and more.

Clear, Transparent Services: Our experts provide clearly defined, transparently priced solutions and service packages. You'll always know exactly what you'll get. No hidden complexity or surprises.

Unbiased Operational Technology Advice: We can match you with the best technology solution to address your property’s specific operational pain points.

Free Strategic Discovery Call: Unsure about exactly what you need? Schedule a complimentary strategic discovery call. We'll help define your project's goals and recommend precisely matched experts.

What They Say

About It

Expert Advice & Unbiased Technology Recommendations are Just a Few Clicks Away.

Let us match you with the best tech solutions and trusted, vetted industry experts to help you solve your most pressing operational problems.

-

✅ Boost direct bookings effortlessly

-

✅ Automate smarter to get more done with less

-

✅ Maximize revenue confidently and quickly

Expert Advice & Unbiased Technology Recommendations are Just a Few Clicks Away.

Let us match you with the best tech solutions and trusted, vetted industry experts to help you solve your most pressing operational problems.

✅ Boost direct bookings effortlessly

✅ Automate smarter to get more done with less

✅ Maximize revenue confidently and quickly

Your hotel deserves clear, expert-powered results that will make a real difference in your bottom line.

Fill out the form.

Get matched.

Level up TODAY!