Revenue Analytics & Jonas Chorum Launch Two-Way Integration for Hotels

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Written by

Mia Kun

in

Revenue Management

Written by

Mia Kun

in

Revenue Management Market share represents a percentage of business a hotel is getting within the market overall.

It can be described in many different ways, however the easiest is to imagine a piece of cake which is called the market. The goal is that our property gets and eats the most cake. The more cake our property gets to eat, the bigger share we have from the market and the better our overall performance.

Market share can be calculated with various formulas to achieve an appropriate ARI, MPI and RGI for the hotel and be able to compare the hotel's performance in all revenue, room nights and ADR positioning.

In the calculation we include the following: rooms revenue, rooms revenue rebates and other rooms revenue such as no shows, early departures, late check out charges and non-distributable service charges.

However we exclude from the calculation the VAT, group cancellation fees, F&B revenue, other revenue and distributable service charges (paid to the team members).

Market Share Index is calculated by dividing the Hotel Results with Competition Results and multiplying it by 100.

As a formula, we have:

Market Share Index = (Hotel Results ÷ Competition Results) x 100

Market Share as mentioned above has different market share indicators. These help hoteliers position their hotel and its performance in the market and in proportion to its competitive set.

Occupancy Index (MPI) = (Occupancy of subject property ÷ Occupancy of Competitive Set) x 100

Average Rate Index (ARI) = (ADR of subject property ÷ AR of competitive set) x 100

(RevPAR of subject property ÷ RevPAR of competitive set) x 100

With HotelMinder, match with vetted hotel experts to solve your operational problems.

If the index is above 100 it means the subject property is ahead of the comp set – hence over performing the comp set.

While if the index is below 100 it means that the competitive set is outperforming the subject property, and the subject property is underperforming.

Furthermore, the Year on Year (YOY) change tells us how the subject property is performing versus the previous year. If the change is positive we are outperforming last year hence we are gaining more share versus last year, while if the change index is negative we are losing share in the market, hence underperforming.

The two components ahead/behind and losing/gaining position the hotel somewhere in the four quadrants that helps us understand the overall performance of the hotel. It also gives us indications on what needs to be improved, what opportunity is out there in the market we might not be capturing and helps us fine tune the overall hotel strategy.

The four position quadrants are below:

Hotel is ahead of the competitions RevPAR, increased YOY gap between hotel and comp set

Hotel is ahead of competition’s RevPAR, but the comp set is catching up as YoY hotel is going back

Hotel is behind the competition’s RevPAR, but hotel is catching up to the comp set and closing the YoY gap

Hotel is behind the competition’s RevPAR, and the gap between hotel and comp set is getting wider

These quadrants give the best representation of the hotel's performance and looking at the hotel and comp set's MPI and ARI we can conduct a more in-depth analysis on overall performance to see were the problem is and what needs to be changed to change the overall positioning of the hotel in the market.

Market share is crucial in understanding the hotel's position in the market and to see an accurate representation of the market as a whole to identify any trends or opportunities that might have been missed in order to maximize the performance of the hotel.

Mia Kun, originally from Hungary, Budapest, has been living in London UK while pursuing her interests in travelling and experiencing other cultures.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

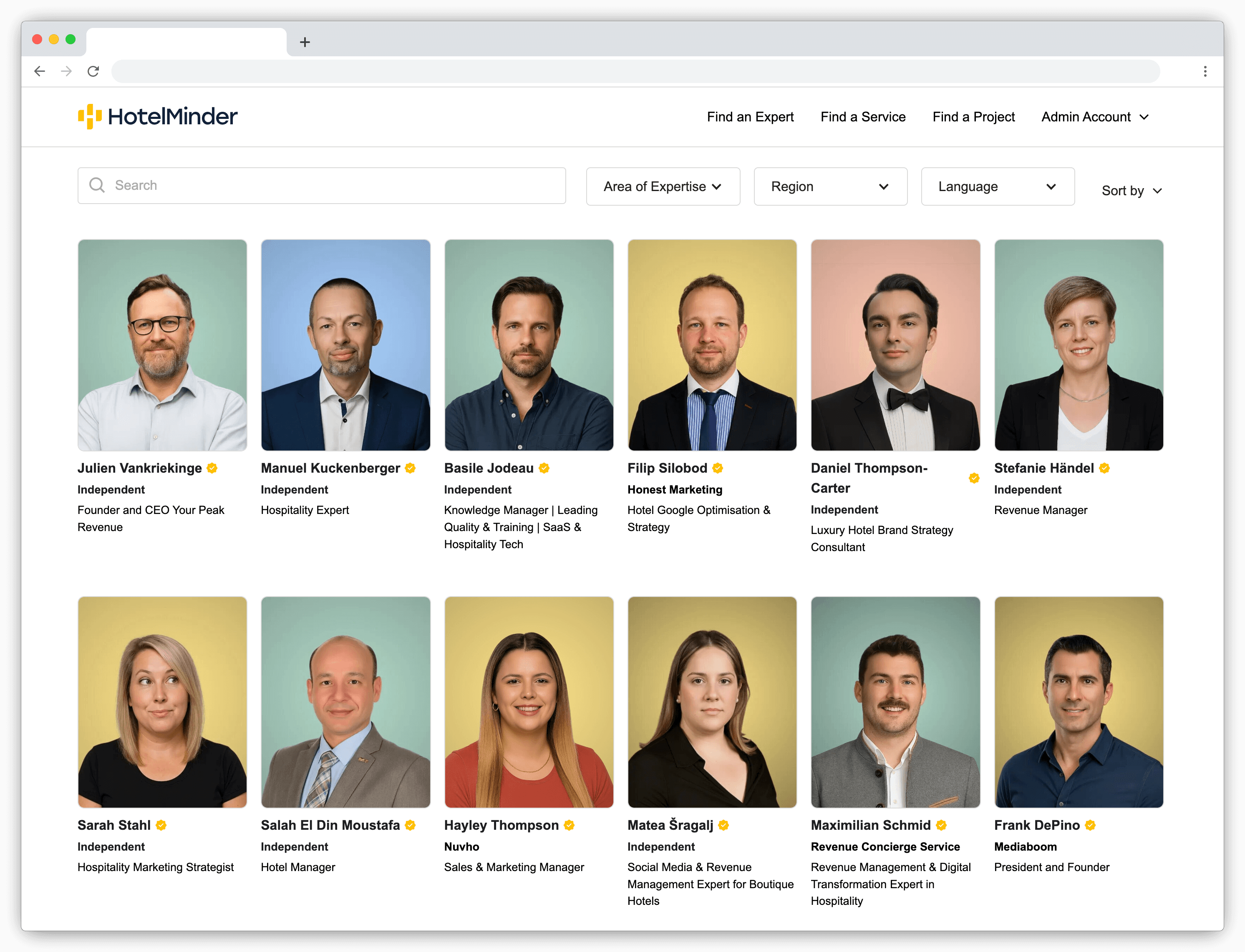

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launched to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Browse Knowledge Hub

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.