Revenue Analytics & Jonas Chorum Launch Two-Way Integration for Hotels

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Written by

Mia Kun

in

Revenue Management

Written by

Mia Kun

in

Revenue Management The basics of Revenue Management aim to sell the right product at the right price to the right customer through the right channel. In order to measure the success of it, we have several different KPIs.

KPI stands for Key Performance Indicators that enable the revenue manager or hotel owner to assess the current state of the business and make adjustments to the pricing and overall strategy based on the outcome.

In our article titled: Top Hospitality KPIs to Evaluate Your Hotel Performance, we have already covered: OR, ADR, RevPAR, and GOPPAR, which are the most useful and popular KPIs used by hoteliers worldwide. If you're not 100% familiar with them, go check them out and then come back for a read here.

If you're already well-informed, let's take a look at the most advanced KPIs used by Revenue Managers, how to use them, and why they are important.

RevPOR stands for Revenue per Occupied room, which as the name suggests, only takes into consideration occupied rooms. For this calculation, we take into account all other revenue streams that are associated with the rooms (laundry, telephone, room service, breakfast, etc.) It allows us to understand what other services guests are using and paying for in order to maximize overall revenue.

RevPOR = Total Revenue Generated by Occupied Rooms / Number of Occupied Rooms

Example: For the month of September, the property made €300,000 Revenue and they have 2000 rooms occupied. This would mean 300000/2000, which is a €150 RevPOR.

With HotelMinder, match with vetted hotel experts to solve your operational problems.

TRevPAR stands for Total Revenue per Available Room. Just like RevPar, it focuses on all the rooms available in the property. However, it takes only the revenue of the room night instead, and takes into consideration other expenses (laundry, room service, restaurant charges, etc.)

TRevPAR = Total Revenue / Total Number of Rooms

Example: For the month of September, the property made in total €500000 revenue and the total number of rooms in the property was 5000 rooms. Based on the calculation: 500000 / 5000 is €100 TRevPAR.

NRevPAR stands for Net revenue per Available Room. It takes into account the total revenue generated per available room. However, this KPI is based on the net revenue. Therefore, all costs that are associated with selling the room are first taken out. This gives the most accurate image of the real revenue received from the sold rooms.

NRevPAR: Total Revenue Cost / Total Number of Rooms

Example: For October, the property has generated €300,000 revenue (net) and the total number of rooms in the property was 3000. Based on the calculation: 300000/3000 is €100 for NRevPAR.

ARPA stands for Average Revenue per Account. This KPI focuses on specific customer accounts rather then property-specific performance. It tells us the revenue generated by the chosen account, and can be calculated monthly or yearly to help business owners decide the value of the business the account brings in. Usually, these are predominantly used for corporate and business accounts but can be used for FITs as well.

ARPA: Monthly Recurring Revenue / Total Number of Accounts

Example: For the month of September, the monthly revenue was €50,000 and we had in total 50 accounts. Based on the calculation: 50000 / 50, the ARPA was €1000 per account.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortisation. It shines light on the day-to-day operational profit generated by the hotel after extracting the different variables, such as interest, tax, depreciation and amortization. It’s an important KPI for investigating the financial performance of the business across different markets and industries.

EBITDA: Total Revenue – All other expenses

Example: In the month of September, the property generated €300,000 revenue and the total expenses associated with it were €50,000. Based on the calculation: 300,000/50,000 equals €250,000 in EBITDA.

Mia Kun, originally from Hungary, Budapest, has been living in London UK while pursuing her interests in travelling and experiencing other cultures.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

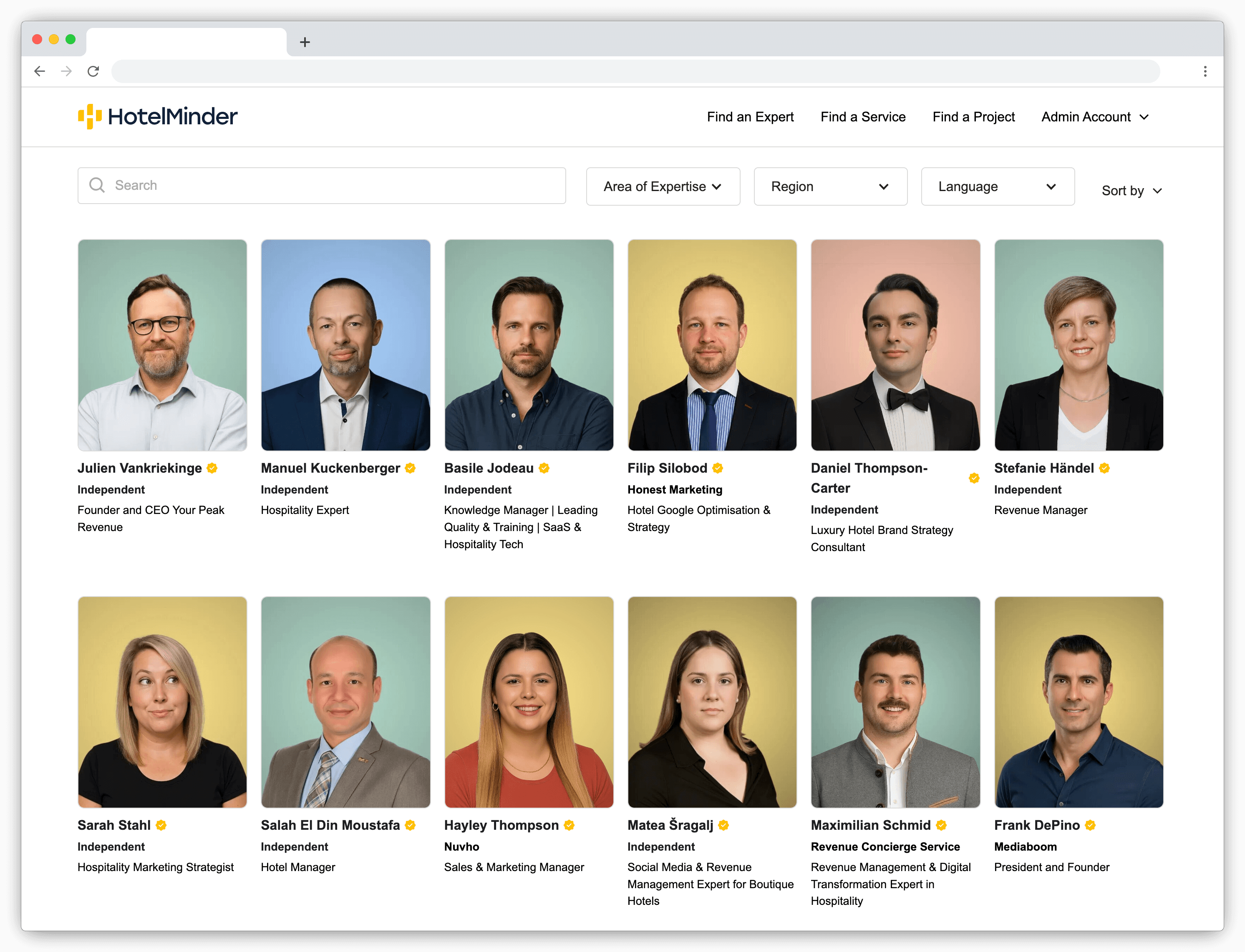

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launched to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Browse Knowledge Hub

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.