7 Steps to Build a Reliable and Stress-Free Hotel Forecast

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

Written by

Swati Mishra

in

Payment Processing Software

Written by

Swati Mishra

in

Payment Processing Software The dynamic digital landscape is the reason behind the evolving payment processing methods in the hospitality industry. Hoteliers strive to provide smooth, quick, and secure transactions for customers. Let’s take a glimpse at the fundamentals of hotel payments and what it means for the future of the hospitality industry.

Hotel payment processing is a process that handles hotel payments when guests use their services.

For example, if you check into a hotel and pay with your credit card, the hotel’s payment system sends your payment information to the payment gateway. These are intermediaries between the hotel’s website or point-of-sale (POS) system and the financial institutions involved in the transaction.

Then comes the payment processor that ensures that the funds are quickly and correctly transferred from the guest’s account to the hotel’s account. Lastly, the payment comes to the merchant account where funds are deposited before being transferred to the hotel’s primary bank account.

That’s how the hotel payment processing works.

Secure payment processing deals with handling sensitive financial data. Security is of utmost importance in hotel payment processing. Hotels must comply with the PCI DSS (Payment Card Industry Data Security Standards) to protect guest’s information against any data breaches.

Security measures include:

Note: Global cybercrime will reach USD 10.5 trillion annually by 2025.

The following methods reflect the diverse payment options used in the hotel industry:

| Payment Method | What is it? | How does it benefit? | Considerations |

|---|---|---|---|

| Digital Wallets | Mobile-based payments like Gpay, ApplePay, SamsungPay, etc |

|

|

| Credit and Debit Cards | Traditional payment methods using chips, magnetic strips, or contactless tech, like EMV cards |

|

|

| Cryptocurrencies | Decentralized digital currencies like Bitcoin |

|

|

| Virtual Credit Cards | Single-use credit card numbers are used for specific transactions, often used by corporate clients and OTAs |

|

|

| Cash | Traditional physical currency used in transactions |

|

|

| Contactless Payments | NFC-enabled devices used for payments allow quick, contactless transactions |

|

|

| Loyalty Points and Rewards | Payment using loyalty points from hotel programs or third-party programs |

|

|

| Prepaid Cards | Cards preloaded with funds Used by budget-conscious travelers like corporate travel cards |

|

|

| Bank Transfers | Direct payment from the guest’s bank to the hotel’s account |

|

|

| Buy Now Pay Later (BNPL) | Allows guests to pay in phases |

|

|

Note: Digital wallets account for 29.8% of global e-commerce transactions in 2023 and continue to rise.

For implementing the best practices in hotel payment processing, here’s what you need:

Hotels integrate payment processing systems with their PMS to facilitate smoother check-ins and check-outs. Marriott International uses integrated payment solutions in all its global properties to streamline operations, enhance guest experience, ensure accurate billing, and improve efficiency.

Different payment methods like digital wallets, credit/debit cards, contactless payments, and more cater to diverse guest needs, thus improving satisfaction and convenience. For example: Hyatt Hotels provides Google Pay and Apple Pay payment options for their guests.

Adherence to PCI DSS, implementation of tokenization, encryption, fraud detection system, etc to safeguard guest’s data and eliminate legal issues. For instance: The Ritz-Carlton uses advanced tokenization and encryption methods to secure their guests’ transactions.

To maintain trust, Hilton Worldwide ensures transparent pricing details during the booking process to help their guests make informed decisions.

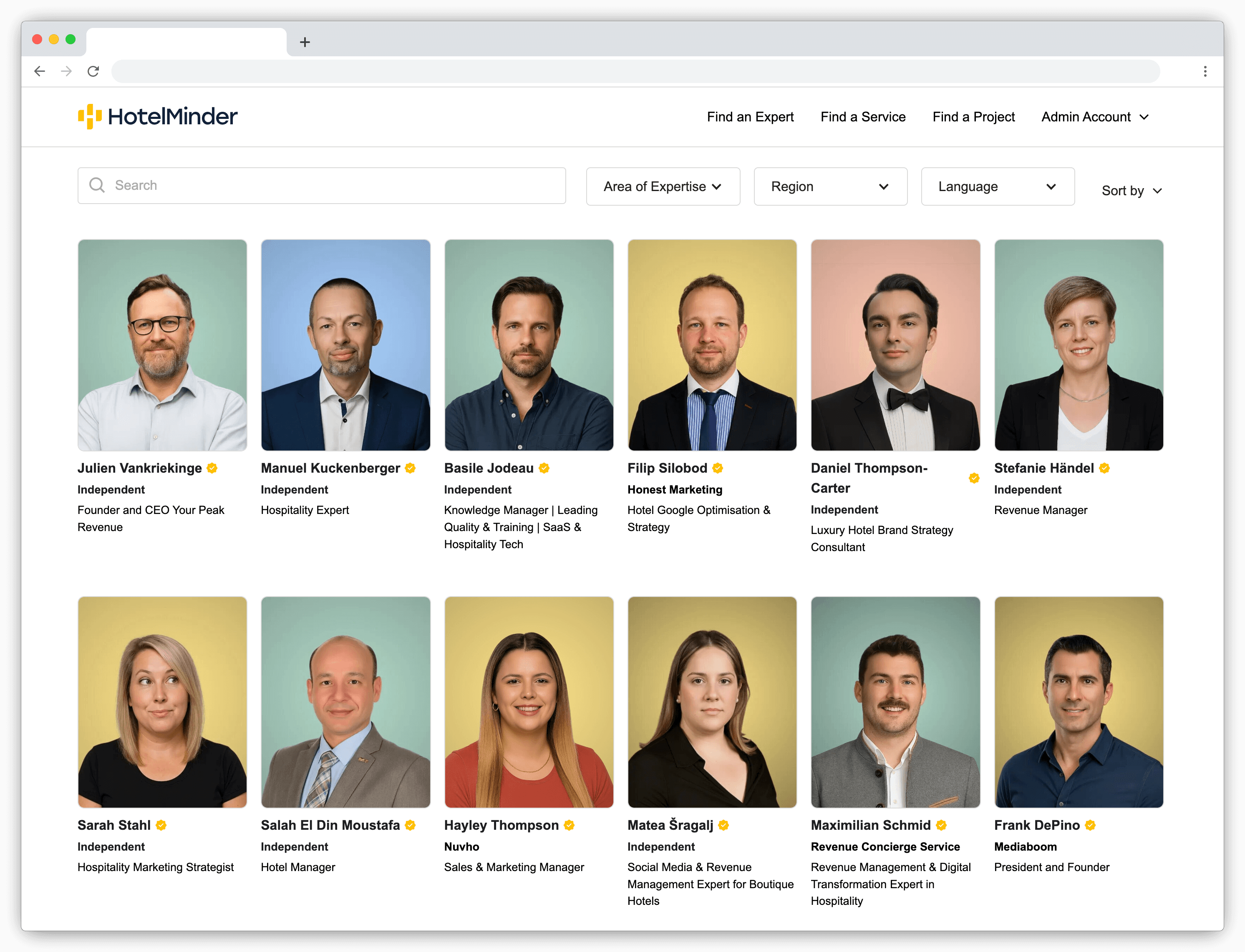

With HotelMinder, match with vetted hotel experts to solve your operational problems.

Routine security audits and staying updated on the latest security protocols help prevent data breaches. A luxury hotel chain in Europe reduced fraud incidents by implementing security audits and upgrading its payment system.

As the industry continues to evolve, hotels keep themselves updated about the latest payment methods, security measures, and emerging trends. Some of them are given below:

A global travel technology firm called OYO partnered with Stripe to enable instant payouts to hotels. With this solution, hotel managers get immediate access to funds via successful transactions that improve financial liquidity. Instant payouts help streamline operations in cash flow management and allow seamless transactions for hotels.

The Upper Deck Resort in India utilized contactless payment technology to improve guest services. They integrated a chatbot to handle customer service requests and assist in payments. With this, their direct booking rates increased by 35%.

A cloud-based property management system integrated a voice-activated payment system in collaboration with The Digital Line and Elavon. An innovative solution that allows guests to make payments via voice commands and provides a futuristic guest experience. The use of Amazon Alexa-powered services is an example of how hotels are leveraging technologies for contactless services to prioritize guest’s comfort and safety.

The hospitality industry continues to evolve and so does the online payment industry. Ai payments, biometric authentication, and many more innovations are still to pave the way to the future of online payments. The blend of these two offers uncountable options for hoteliers to provide seamless transactions to their guests. If you’re baffled by the number of options present and want to know it from the experts, reach out to HotelMinder.

Swati is an accomplished content marketing specialist who focuses on developing valuable and practical content that addresses the concerns of hospitality businesses end-users.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launching to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Browse Knowledge Hub

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Learn Generative Engine Optimization (GEO) to boost your hotel's visibility on AI platforms like ChatGPT. Our guide covers websites, reviews, and OTAs. Get seen.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.