7 Steps to Build a Reliable and Stress-Free Hotel Forecast

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

When you run an hospitality business efficient financial management is critical to success. Hotel accounting software has become an indispensable tool for modern properties, transforming how hotels handle their finances.

From automating daily tasks to providing real-time insights, this specialized software streamlines operations, improves accuracy, and drives profitability. Whether you're managing a boutique property or a hotel chain, choosing the right accounting solution can make all the difference.

This guide explores the essential features, benefits, and selection criteria to help you find the best software for your hotel’s needs.

If you’re new to the world of Accounting Software solutions in the hospitality industry, start here.

Cloud financials with automation for AP/AR, multi-entity reporting.

Sage Intacct is a cloud-based financial management solution tailored for mid-sized hotel chains requiring automation and multi-entity reporting. It excels in automating accounts payable/receivable processes, reducing manual data entry, and providing real-time visibility into financial performance across properties. Hoteliers benefit from its ability to consolidate revenue streams, track departmental expenses (e.g., F&B, housekeeping), and generate granular reports for compliance with hospitality audit standards.

Integrations with PMS platforms via API, alongside tools like Salesforce CRM and Avalara for tax automation, ensure seamless data flow between systems. Sage Intacct's dashboards and KPIs are customizable to hotel-specific metrics, such as RevPAR and occupancy rates, aiding in strategic decision-making.

Starting at $400/month, it scales efficiently with growing hotel groups, particularly in North America, where its cloud infrastructure supports remote financial management. Ideal for mid-sized chains prioritizing automation and scalability, Sage Intacct bridges the gap between generic accounting software and the nuanced demands of hotel finance teams.

Hospitality-focused accounting with budgeting, payroll, and compliance tools.

M3 Accounting Core is a hospitality-specific financial management platform designed to streamline complex accounting workflows for hotels. Built with the unique needs of hoteliers in mind, it offers robust tools for budgeting, payroll management, and compliance with industry regulations like ASC 606 revenue recognition.

The software integrates seamlessly with popular property management systems (PMS) such as Oracle Opera, enabling real-time data synchronization for accurate financial reporting across departments. Its multi-property support simplifies consolidated financial statements for hotel groups, while features like automated bank reconciliation and customizable audit trails reduce manual errors.

M3's pricing starts at $150/month per user, making it a cost-effective option for mid- to large-sized hotels, particularly those in the midscale to upscale segments. Its strong integration ecosystem (e.g., Salesforce CRM, ADP payroll, QuickBooks) and focus on hospitality compliance make it a reliable choice for North American and European hotels seeking scalability without sacrificing industry-specific functionality.

Instantly connect with a trusted expert for tailored recommendations.

Expert MatchHotel accounting software helps properties manage their financial operations, from daily transactions to long-term financial planning. At its core, it tracks revenues, expenses, and profitability across all hotel departments - rooms, F&B, events, spa services, and other revenue centers.

Unlike generic accounting solutions, hotel-specific software is built to handle hospitality's unique challenges: multiple payment methods, split folios, room charges, travel agency commissions, and dynamic pricing models. It integrates directly with Property Management Systems (PMS) and Point of Sale (POS) systems to automatically record and categorize transactions without manual intervention.

Most importantly, hotel accounting software consolidates financial data from various sources into standardized reports that help managers track performance metrics like RevPAR, departmental profitability, and labor costs. This enables data-driven decisions about pricing, staffing, and operational efficiency while ensuring compliance with accounting standards and tax regulations.

The most critical features in hotel accounting software center around automation, integration, and real-time insights.

Automated daily reporting pulls data directly from your PMS, saving up to 45 minutes daily while eliminating manual entry errors. Real-time financial tracking provides instant visibility into cash flow and transaction processing, enabling quick, informed decisions.

Multi-department accounting capabilities handle revenue streams from rooms, F&B, and ancillary services while maintaining clear departmental separation. The system must comply with local accounting regulations and tax requirements to ensure accurate reporting and avoid compliance issues.

Your accounting software must integrate seamlessly with:

Strong API connections ensure data flows accurately between systems, creating a single source of truth for all financial information.

Consider advanced capabilities like predictive analytics for revenue forecasting, automated invoice processing, and multi-property support if managing multiple locations. Mobile accessibility and customizable reporting frameworks help different stakeholders access relevant information quickly.

Choose software that matches your property's specific needs and integrates well with existing systems rather than the one with the most features.

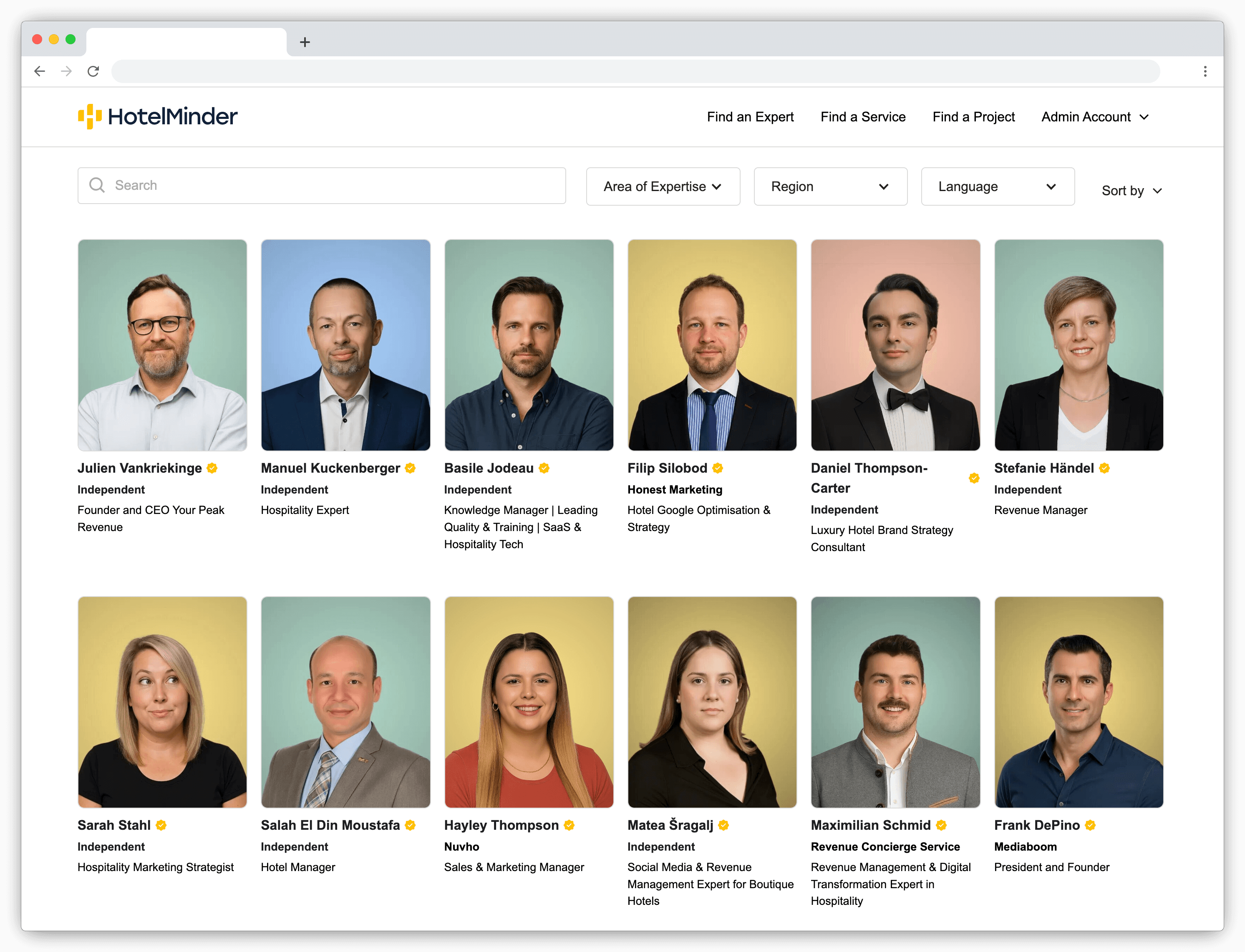

With HotelMinder, match with vetted hotel experts to solve your operational problems.

Modern hotel accounting software transforms financial management from a time-consuming necessity into a strategic advantage. Here's how it delivers value across your operation:

Automation eliminates hours of manual work by directly capturing transactions from your PMS and POS systems. Daily reports, invoice processing, and bank reconciliations happen automatically, freeing your staff to focus on guest service and strategic tasks.

Real-time data access enables immediate response to financial trends. Rather than discovering issues at month-end, managers can monitor performance daily and adjust operations accordingly. This visibility helps optimize pricing, control costs, and maximize revenue opportunities.

Financial control improves through standardized processes and built-in compliance checks. The software enforces consistent accounting practices across departments and properties while maintaining detailed audit trails. This reduces errors, prevents fraud, and simplifies tax preparation.

Better decision-making comes from comprehensive reporting and analytics. By consolidating data from all revenue streams, the software provides clear insights into departmental performance, helping identify both problems and opportunities. These insights guide strategic decisions about staffing, pricing, and resource allocation.

Most importantly, proper accounting software typically pays for itself through reduced labor costs, better financial control, and improved revenue management. Properties often report 20-30% time savings in accounting tasks alone, not counting the benefits of better financial insights.

Start by evaluating your hotel’s specific needs. Consider the size and complexity of your property (single hotel vs. multi-property), volume of transactions, and integration requirements with your PMS, POS, and other systems. Look for software that offers robust automation, customizable reporting, and real-time financial insights. Scalability is key—ensure it can grow with your business. Check for compliance with local regulations, and prioritize user-friendly interfaces to minimize training time.

Implementation can be complex, so ensure the vendor provides adequate support during the transition. Assess the time and resources required for setup and data migration. Train your staff thoroughly to maximize adoption and minimize errors. Test integrations with your PMS and other systems before going live to avoid disruptions.

To calculate ROI, consider both cost savings and revenue growth. Look for reductions in manual labor (e.g., fewer hours spent on invoicing or reconciliation), improved efficiency, and faster financial reporting. Factor in potential revenue boosts from better cash flow management and data-driven decision-making. Compare these benefits to the software’s total cost of ownership (subscription fees, implementation, training) to determine its value to your hotel.

Yes, generic accounting tools lack hospitality-specific features like PMS integration, governmental compliance, and capabilities to handle split folios, room charges, and travel agency commissions. Hotel accounting software is tailored to meet the unique financial needs of the hospitality industry.

The software streamlines operations by automating repetitive tasks, improves accuracy with real-time data synchronization, enhances decision-making through advanced reporting, ensures compliance with accounting standards, and boosts profitability by identifying cost-saving opportunities.

It integrates seamlessly with Property Management Systems (PMS), Point of Sale (POS) systems, payroll platforms, banking tools, and revenue management systems. Strong API connections ensure smooth data flow between systems, eliminating manual errors.

Prioritize automation, real-time financial tracking, multi-department accounting, compliance with local regulations, and customizable reporting. Advanced features like predictive analytics, mobile accessibility, and multi-property support are also valuable.

Implementation typically takes 4–12 weeks, depending on property size and complexity. Key steps include data migration, integration setup, staff training, and testing.

Most vendors offer monthly subscriptions based on features, integrations, and property size. Implementation costs are minimal unless custom integrations are required. Some hotels may need to rent or purchase hardware for on-premise solutions.

Consider both cost savings (e.g., reduced manual labor, fewer errors) and revenue growth (e.g., better cash flow management, optimized pricing). Compare these benefits to the total cost of ownership, including subscription fees, implementation, and training.

Yes, many solutions offer multi-property support, allowing you to consolidate financial data across locations while maintaining individual property reporting. This is ideal for hotel chains or management companies.

It adheres to industry standards like USALI and local tax regulations, ensuring accurate financial reporting and reducing the risk of penalties. Built-in compliance checks and detailed audit trails simplify tax preparation and audits.

Key questions include:

With 15+ years of experience in supporting hoteliers in optimizing their operations and launching innovative hotels around the world, Benjamin Verot (a.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launching to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Learn Generative Engine Optimization (GEO) to boost your hotel's visibility on AI platforms like ChatGPT. Our guide covers websites, reviews, and OTAs. Get seen.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.