Revenue Analytics & Jonas Chorum Launch Two-Way Integration for Hotels

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Payment processing in hospitality is uniquely complex due to the industry's specific requirements: multiple payment touchpoints, advance deposits, extended stays, and post-stay charges.

While hospitality tech vendors too often obscure the complexities of online payment systems to maintain high profit margins, understanding the fundamentals is crucial for optimizing costs and improving guest experience.

This guide breaks down everything hoteliers need to know about payment processing, from basic concepts to advanced strategies for cost optimization.

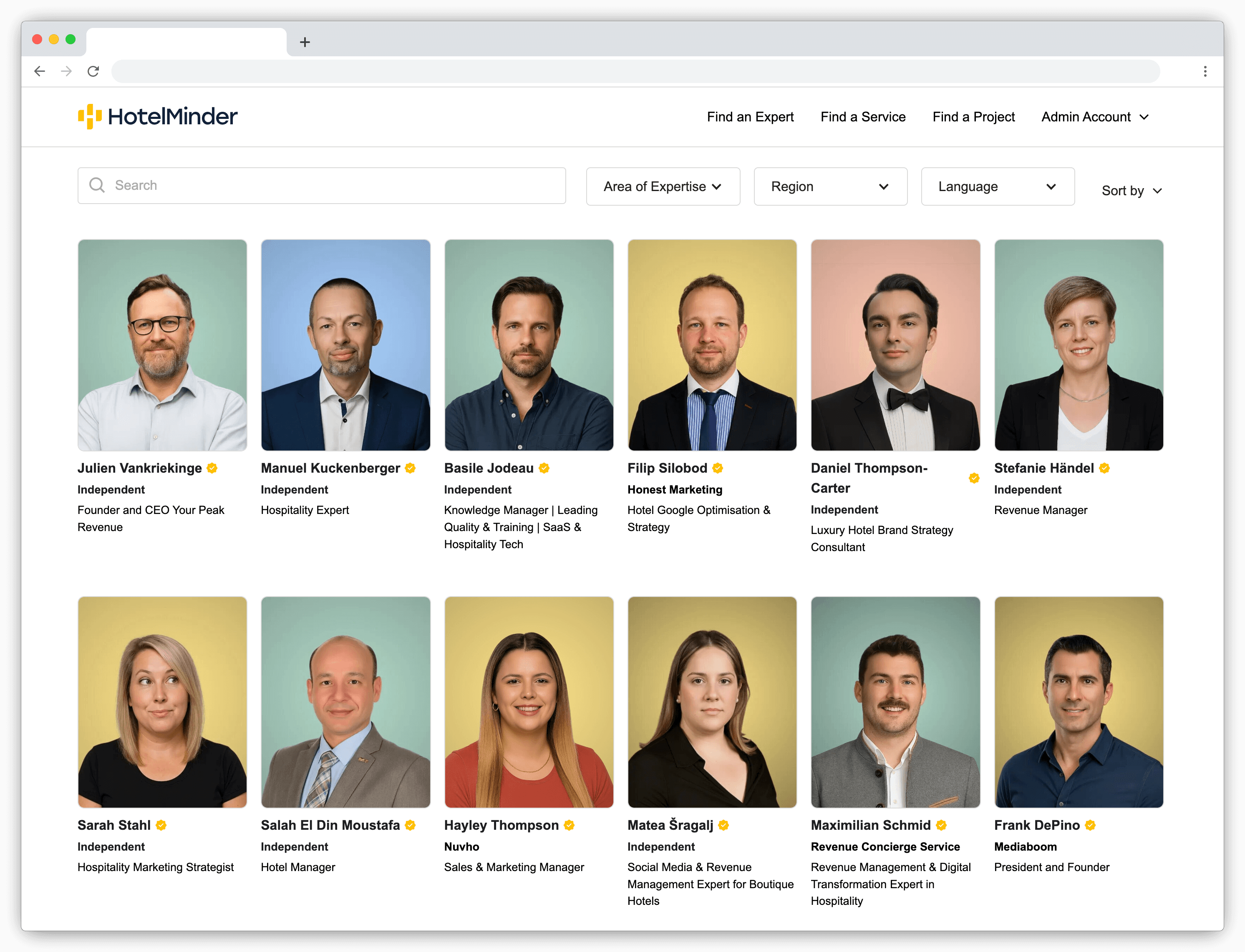

Start your search with our most popular solutions below. You can use the filters to narrow down your search.

Cloudbeds is hospitality's only intelligent growth engine — a unified platform trusted by the world's most ambitious hoteliers across 150 countries.

Built to challenge the limits of outdated tech stacks, Cloudbeds connects operations, revenue, distribution, and guest experience in one powerful, intuitive system.

The platform is enhanced with Signals, a hospitality AI model giving hoteliers the power to anticipate demand, run smarter operations, and craft more personal, profitable guest journeys at scale.

Founded in 2012, Cloudbeds has earned top honors from Hotel Tech Report (Top PMS, Hotel Management System, and Channel Manager, 2021–2025), the World Travel Awards (World's Best Hotel PMS Solutions Provider, 2022), and Deloitte's Technology Fast 500 (2024).

Stripe is a comprehensive online payment processing platform designed to help businesses manage transactions smoothly and securely.

Stripe's primary product offerings include payment processing for online and in-person transactions, as well as a variety of tools for managing revenue, invoicing, and financial operations. The platform supports numerous payment methods, including credit and debit cards, PayPal, Apple Pay, and Google Pay, allowing businesses to accept payments globally. Stripe offers a range of customizable checkout options, ensuring that businesses can tailor the payment experience to their specific needs.

For businesses requiring physical payment solutions, Stripe Terminal offers pre-certified card readers and support for contactless payments through mobile devices. Stripe's Connect feature is particularly beneficial for platforms and marketplaces, enabling them to manage payments, automate tax collection, and handle subscriptions with ease.

Planet offers an integrated suite of software and payment solutions designed to enhance operational efficiency and guest experiences in the hospitality industry.

Planet's Property Management System (PMS), formerly known as Protel and Hoist Group, is tailored specifically for hoteliers to streamline operations. The cloud-based PMS allows hotels, spas, resorts, and multi-property groups to manage everything from check-ins and check-outs to billing and invoicing. This integrated system ensures seamless communication across departments, freeing up hospitality staff to focus on providing excellent guest service.

Planet also provides an advanced Hotel Booking Engine, aiding hoteliers in maintaining a competitive edge by offering potential guests an easy, efficient booking journey. Their booking engine is designed to convert website visitors into confirmed guests, thereby maximizing occupancy and revenue.

The Interactive TV solution by Planet delivers a modern entertainment experience for hotel guests. It includes free and paid live channels, video on demand, music streaming, and various apps, ensuring a comprehensive in-room entertainment package.

Planet's Network and Connectivity solutions offer state-of-the-art technology, providing high-speed internet, TV services, and in-room entertainment options that enhance guest satisfaction. Their robust networking capabilities also open revenue-generating opportunities for hoteliers through premium services.

Additionally, Planet's Dashboard tool provides critical data-driven insights, helping hoteliers visualize data to improve guest satisfaction, grow revenue, and better manage their brand. The dashboard aids in monitoring key performance indicators and making informed decisions that drive business success.

Planet supports a range of guest payment options with their End-to-End Payment solutions, which include Dynamic Currency Conversion (DCC) and Multi-Currency Pricing. These features allow guests to pay in their preferred currency and method, enhancing their payment experience while enabling hoteliers to capture additional revenue.

Authorize.net is a payment gateway service that allows merchants to accept online payments through their website or mobile app. The service provides a secure and reliable platform for processing credit card and electronic check transactions.

Authorize.net offers a variety of features and tools to help businesses manage their payments and reduce the risk of fraud. These include advanced fraud detection and prevention tools, recurring billing options, a virtual terminal for manual payments, and a suite of reporting and analytics tools.

Instantly connect with a trusted expert for tailored recommendations.

Expert MatchThe hotel payment ecosystem operates through several key players working together to process transactions securely and efficiently:

Guest (Cardholder) — The guest starts the payment process using their credit card and can dispute charges through their bank if needed.

Hotel (Merchant) — The hotel accepts payments while maintaining PCI-compliant systems and manages payment-related customer service.

Payment Processor — The processor routes transaction information between parties and handles the technical aspects of payment settlement.

Card Networks — Visa, Mastercard, and others maintain the global payment infrastructure and set the rules and fees for card transactions.

Issuing Bank — The guest's bank provides credit cards, authorizes transactions, and handles cardholder disputes.

Acquiring Bank — The hotel's bank maintains merchant accounts and deposits processed funds into the hotel's account. These players interact seamlessly during each transaction, communicating in seconds to verify, process, and settle payments. Understanding their roles helps hoteliers optimize payment operations and resolve issues effectively when they arise.

Here, it’s important to note that the payments industry has seen significant consolidation, with many traditional processors merging or being acquired. Modern Payment Service Providers (PSPs), like Stripe, Square or Ayden provide the technological interface and bundle multiple of the payment services listed above into one solution. Some providers also white-label their processing services to other companies.

Hotels must accommodate various payment methods to meet guest preferences and market demands. Here's an overview of the main payment methods and their implications.

These occur when guests physically present their cards at the hotel. Modern terminals support chip & PIN technology for enhanced security, while contactless payments offer convenience for smaller amounts.

Card-present transactions generally have lower processing fees and fraud risks since the physical card and often the cardholder's identity can be verified in person.

Online bookings and phone reservations fall into this category, along with virtual cards commonly used by OTAs. These transactions carry higher fees and security risks due to the inability to physically verify the card.

Hotels must implement additional security measures like 3D Secure and CVV verification to protect against fraud. Virtual cards are increasingly common for OTA payments, offering enhanced security through single-use numbers.

A crucial point for hoteliers to watch is the cost of Virtual Credit Cards (VCCs) from OTAs. While convenient, these VCCs often come with high, fixed processing fees—for example, around 2% for those issued by Booking.com. This rate is significantly higher than what you would pay for a standard domestic card and can quietly erode your profit margin on OTA bookings.

Always factor these non-negotiable fees into your channel management strategy.

Digital wallets like Apple Pay and Google Pay are gaining popularity, combining security with convenience.

Bank transfers remain relevant for group bookings and long-term stays, with SEPA Instant Credit Transfer offering real-time settlements across Europe - a significant improvement over traditional SEPA transfers that could take 1-2 business days.

At HotelMinder, we expect SEPA Instant to become ubiquitous and widely used across Europe and for Europeen guests.

“Buy Now Pay Later” solutions like Klarna are emerging in the hospitality sector, particularly for advance bookings.

It’s also worth noting regional payment methods such as WeChat Pay and Alipay are essential for hotels serving international guests, especially from Asian markets.

Hotels should carefully evaluate which payment methods to accept based on their target market, considering both operational costs and guest preferences.

Before we dive deeper into the complex subject of hotel payment processing, it’s important to make sure some of those often used terms are clear and well understood:

A bank account that allows businesses to accept card payments. Hotels may have multiple merchant accounts for different currencies or properties.

The software that securely sends payment data to processors. Think of it as the digital equivalent of a physical card terminal.

The service that routes transactions between banks. Unlike gateways, processors handle the actual movement of funds. Note that the distinction between gateways and processors has become increasingly blurred as many modern providers offer both services in one package.

The base cost charged by card networks for processing transactions. Fees vary by card type and transaction method.

Temporary fund reservations during check-in that block a specific amount without actually charging it.

Forced refunds initiated by guests through their banks, often resulting in additional fees for hotels.

Required security standards for businesses handling card data. Non-compliance can result in significant fines.

The process of replacing sensitive card data with secure tokens for storage and future transactions.

An additional security layer for online payments, requiring cardholders to verify their identity with their issuing bank.

Many, if not most, modern Property Management Systems (PMS) now include integrated payment processing one way or the other. It can be either an external or an internal solution.

With HotelMinder, match with vetted hotel experts to solve your operational problems.

In this case, the external Payment Processor is integrated into the PMS through APIs or other middleware solutions.

Hotels can work directly with payment processors or gateways independently of their PMS.

This approach typically offers more flexibility in processor choice and potentially lower rates, but may require additional technical setup and maintenance.

Stripe is a developer-centric platform with extensive API documentation and modern interface. Standard rates of 1.4% + €0.25 for European cards, 2.9% + €0.25 for international cards. Popular choice for digital-first properties.

Adyen is an Enterprise-focused solution offering advanced features and global payment methods. Complex interchange++ pricing model. Minimum monthly invoice of €100 or 2.5% + €0.10 per transaction. Best suited for large hotel groups.

Worldpay is a traditional hospitality-focused provider with established banking relationships. Custom pricing based on volume, typically ranging from 1.5% to 2.5% + fixed fee. Strong presence in European markets.

Examples of PMS solutions offering external payment solutions: 5stelle, Clock, etc

This means the PMS vendor either has pieced together their own payment processing infrastructure, or has partnered with a specific processor to offer white-labeled payment services (often with Stripe).

The result is a deeply integrated payment process from within the PMS.

Examples of PMS solutions offering built-in payment solutions: Cloudbeds, Little Hotelier, Mews, HotelTime, etc

Hotels can choose from different pricing structures for payment processing. Understanding these is crucial for cost optimization.

Here's a detailed comparison of the two main models:

Interchange++ (IC+), also called "Interchange Plus Plus", consists of three distinct components:

Therefore, the pricing structure for Interchange++ (IC+) is literally:

Interchange + Scheme Fees + Processor Markup = Total Cost

If interchange fee is 1.5% + €0.10, and processor markup is 0.5% + €0.10, then the total fee would be 2% + €0.20

A simplified pricing model offering a flat percentage fee for all transactions, such as 2.9% + €0.30 per transaction, regardless of card type or transaction method.

Blended rates are typically proposed by Payment Service Providers (PSPs) and payment facilitators who target small to medium-sized businesses.

Example: Flat 2.9% + €0.30 for all transactions regardless of card type

Note: Regional variations play a significant role in payment processing costs, with rates varying substantially between North America, Europe, and Asia-Pacific markets. While these figures provide a general framework, actual costs depend heavily on your location, transaction volume, and the specific card schemes dominant in your market.

| Fee Type | Blended | IC++ | Integrated |

|---|---|---|---|

| Domestic Consumer Credit | 2.9% | 0.3-1.0% + 1.2-1.5% + 0.5% = 2.0-3.0% | 2.7% |

| Domestic Consumer Debit | 2.9% | 0.2-0.8% + 0.8-1.2% + 0.5% = 1.5-2.5% | 2.7% |

| International Cards | 2.9-3.5% | 1.5-2.0% + 1.5-2.0% + 0.5% = 3.5-4.5% | 3.2-3.8% |

| Corporate/Premium Cards | 2.9-3.5% | 1.8-2.2% + 1.8-2.2% + 0.5% = 4.1-4.9% | 3.5-4.0% |

Built on top of Stripe, Cloudbeds Payments offers two distinct pricing models:

Built on top of Stripe, Mews Payments uses a hybrid pricing model:

This hybrid approach, mixing IC++ and blended rates, is becoming a common strategy for PMS providers to balance costs and complexity, with others like HotelTime adopting similar models.

HotelTime has recently transitioned to a deeply integrated, built-in payment solution, partnering with major processors to offer a global service. The system leverages Adyen in Europe and NomuPay in Asia, operating on a sophisticated hybrid pricing model: Interchange++ (IC++) for Visa/Mastercard in Europe, and blended rates for other cards and for the Asian market.

This approach allows for advanced automation of OTA payments, secure payment links, and a virtual terminal. A tokenization fee (around €0.10 per card) applies for card storage (a standard cost for this level of integration). The seamless connection also extends to their POS system, enabling features like QR code ordering and removing the need for physical payment in F&B outlets.

Built on top of Stripe, SabeePay offers a straightforward pricing model with a 0.5% convenience fee on top of standard Stripe fees.

Your property's size and transaction volume determine which payment solution and pricing model will work best. Here's how to match your profile with the optimal solution:

| Property Size | Annual Volume | Recommended Approach | Pricing Model & Rates | Key Points |

|---|---|---|---|---|

| Small (<30 rooms) | Under €500K | Native PMS Solutions | Blended: 2.9-3.5% |

✓ Simpler setup reconciliation

✓ Single vendor support

× Higher overall costs

× Limited negotiation power

|

| Medium (30-100 rooms) | €500K-2M | Hybrid or IC++ Solutions | IC++: Base + 1.0-1.2% markup |

✓ Flexibility to choose

✓ Some negotiating power

× More complex setup

|

| Large (100+ rooms) | Over €2M | Direct Payment Processor | IC++: Base + 0.5-0.7% markup |

✓ Lowest possible rates

✓ Custom solutions

× Complex integration

× Requires tech expertise

|

Note: These thresholds are approximate and can vary by market and provider.

Smaller properties typically benefit from the simplicity of blended rates, while larger operations can leverage their volume for better pricing.

Many hoteliers focus solely on processing rates, but hidden fees can significantly impact total cost of ownership. Here are the most critical fees to evaluate before signing any agreement:

Possibly the most overlooked yet significant cost for hotels. Processors typically charge €0.10-0.50 per stored card, regardless of whether you process a payment.

With hundreds of reservations monthly, these fees can add up quickly. In some situations with the potential to even surpass yearly PMS subscription fees!

Who charges tokenization fees: Mews

These fees often hide in exchange rates, typically adding 1-3% markup. Dynamic Currency Conversion (DCC) can add another layer of costs.

Some providers offer better rates for specific currency pairs - negotiate these if you have consistent foreign transaction volumes.

Beyond the disputed amount, each chargeback typically incurs €15-40 in handling fees. These include investigation fees, resolution fees, and additional penalties if the dispute is lost.

Protect yourself by collecting strong documentation, implementing 3DS2 authentication, and maintaining clear cancellation policies.

Pro Tip: Request a complete fee schedule and calculate total cost based on your typical transaction patterns, not just the headline processing rate. Consider seasonal fluctuations in your calculations.

Before selecting a payment solution, ensure it offers these essential capabilities for modern hotel operations:

Virtual Terminal Access — Essential for taking phone reservations and manual payments. Look for solutions offering secure card entry, saved payment methods, and detailed transaction history. Should allow multiple staff access levels and provide clear audit trails of all manual transactions.

Mobile Payment Support — Critical for modern operations, especially for properties with restaurants, spas, or room service. Ensure support for major digital wallets (Apple Pay, Google Pay), QR code payments, and contactless transactions. Mobile solutions should work seamlessly with your PMS for real-time room charging.

Multi-currency Processing — It’s not just about accepting different currencies, but processing them efficiently. Your solution should offer real-time exchange rates and the ability to settle in multiple currencies. Ensure pricing for currency conversion is transparent and that the system supports local payment methods in your key source markets.

Fraud Prevention Tools — Modern fraud prevention goes beyond basic security checks. Look for solutions offering 3DS2 support, combined with intelligent fraud scoring and monitoring. The system should balance security with guest convenience, avoiding unnecessary payment friction.

Native PMS Payments — Directly integrated with your PMS, these solutions offer simplicity and unified support. Processing rates are typically higher (2.7-3.5%), but setup is minimal. Best for small properties prioritizing ease of use over cost optimization.

Third-Party Solutions — Independent providers offering more competitive rates (1.5-2.5%) and greater flexibility. Require separate integration but provide better reporting tools and custom features. Ideal for larger properties with technical resources and negotiating power.

Payment Facilitators (PayPal, Stripe) — Quick to set up with transparent pricing, but usually more expensive (2.9-3.5% + fixed fee). Offer excellent developer tools and instant onboarding. Best for properties needing immediate solutions or those with low transaction volumes.

Bank-Direct Solutions — Traditional merchant accounts offering the lowest possible rates for qualified properties. Require longer setup times and often annual commitments, but provide dedicated support and custom pricing. Suited for established properties with strong financials.

Pro Tip: Rather than focusing solely on rates, calculate total cost of ownership including all fees, integration time, and support needs. The cheapest processor isn't always the most economical solution

Understanding the true cost of payment processing can significantly impact your hotel's bottom line.

While blended rates appear simpler, they often mask substantial potential savings available through interchange++ pricing.

The difference can amount to tens of thousands of euros annually, depending on your property size, guest mix, etc.

Our calculator helps you cut through the complexity by comparing different pricing models using your actual business data and quoted rates.

Get in touch with us to get access to the free calculator!

Selecting the right payment solution requires balancing current needs with future capabilities.

While smaller properties can manage with standard solutions, complex setups involving multiple properties or international payments often need expert guidance.

As the industry evolves toward contactless, mobile, and real-time payments, choose a solution that offers both competitive pricing and the flexibility to adapt to emerging technologies.

Regular review of your payment strategy ensures you stay competitive and meet changing guest expectations.

To help navigate the intricate landscape of hotel payment processing and ensure you're making the most cost-effective choice for your property, consider working with a vetted payment processing expert who can analyze your specific needs and negotiate optimal terms.

With 15+ years of experience in supporting hoteliers in optimizing their operations and launching innovative hotels around the world, Benjamin Verot (a.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launched to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.