Revenue Analytics & Jonas Chorum Launch Two-Way Integration for Hotels

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Written by

Swati Mishra

in

Branding

Written by

Swati Mishra

in

Branding The hospitality industry is a competitive landscape, with major players like Marriott, Hilton, IHG, and Hyatt dominating through extensive brand portfolios tailored to diverse traveler segments. These hospitality giants operate thousands of properties worldwide, leveraging unique brand identities to capture specific demographics, from luxury seekers to budget-conscious travelers.

Understanding their ownership structures, brand ecosystems, and strategic directions is essential for hotel owners, investors, and guests navigating this complex market.

This article provides a comprehensive guide to the ownership, brand portfolios, and recent developments of Marriott International, Hilton Worldwide Holdings, InterContinental Hotels Group (IHG), and Hyatt Hotels Corporation, with insights into their strategies, challenges, and guest experiences as of July 2025.

Hotel chains develop distinct brands to cater to specific traveler segments, such as luxury, midscale, or extended-stay guests. Marriott, Hilton, IHG, and Hyatt are among the largest players and 4 of the most recognized luxury hotel brands, managing thousands of properties globally through an asset-light model. Instead of owning most physical properties, these companies act as brand managers and operators, minimizing capital investment while maximizing global reach.

The asset-light model drives expansion through:

This approach reduces financial exposure to real estate, allowing these brands to focus on brand development, marketing, technology, and loyalty programs. For investors, success hinges on operational efficiency and consistent quality across third-party-owned properties. However, challenges like labor shortages, competition from short-term rentals, and geopolitical risks can impact growth.

The table below summarizes key metrics for these brands as of Q3 2024 or early 2025:

Marriott International, headquartered in Bethesda, Maryland, and led by President and CEO Anthony Capuano, is the world’s largest hotel company. As of early 2025, its vast portfolio included over 9,500 properties across 141 countries and territories.

Marriott's asset-light model is a well-oiled machine. The company's revenue is primarily driven by fees from its managed and franchised properties. This focus allows it to pour resources into its industry-leading loyalty program, Marriott Bonvoy, which surpassed 237 million members worldwide. This program is a cornerstone of its strategy to drive direct bookings and reduce reliance on third-party Online Travel Agencies (OTAs).

Strategically, Marriott is focused on global expansion, particularly in the luxury and all-inclusive segments, and is aggressively pursuing conversion deals with independent hotel owners.

With over 30 brands, Marriott's portfolio is the most extensive in the industry:

Marriott is expanding its midscale and leisure portfolios. Four Points Flex by Sheraton, launched in 2023, targets conversions with 25 hotels in Europe and Japan, aiming for 50+ by 2026. StudioRes, a budget extended-stay brand, has 35 U.S./Canada properties in the pipeline for 2025 openings. The all-inclusive resort portfolio grows in the Caribbean/Latin America, with 2024 openings like Marriott Cancun and Almare, and 21% of the region’s pipeline.

Founded in 1919 by Conrad Hilton and now led by President and CEO Christopher J. Nassetta, Hilton is a hospitality powerhouse. Headquartered in McLean, Virginia, Hilton's global footprint includes over 8,600 properties across 126 countries and territories as of Q1 2025.

Hilton is a prime example of a successful asset-light strategy, with a heavy emphasis on franchising. Its robust development pipeline reached approximately 500,000 rooms in 2025, a record high. A key part of its strategy involves leveraging its powerful loyalty program, Hilton Honors, which has grown to over 220 million members.

Hilton has also made significant strides in digital innovation, enhancing its mobile app with features like Digital Key and Confirmed Connecting Rooms. A notable strategic priority is its Travel with Purpose ESG program, which aims to halve carbon and water intensity by 2030 while promoting social impact.

Hilton's portfolio features more than 24 distinct brands:

Hilton is actively expanding its newer brands. Spark by Hilton, a premium economy conversion brand launched in 2023, surpassed 100 hotels globally by 2024, with growth in the US, UK, Canada, and plans for India, Turkey, and Europe. Hilton’s 2024 partnership with Small Luxury Hotels of the World (SLH) expanded its luxury portfolio with approximately 450 independent hotels, enhancing offerings for Hilton Honors members.

InterContinental Hotels Group (IHG), led by CEO Elie Maalouf since July 2023, traces its roots to 1777 with Bass Brewery. Headquartered in Windsor, Berkshire, England, IHG is a global hospitality leader with over 6,600 hotels across 100+ countries. In 2024, IHG’s hotels generated system-wide revenue of approximately $22 billion, while corporate revenue reached $2.3 billion with a $1.1 billion operating profit.

IHG’s asset-light model, with over 80% of its portfolio franchised, enables rapid expansion using partner capital, supporting a development pipeline of over 2,200 hotels. The IHG One Rewards program, with over 145 million members, drives direct bookings through benefits like Platinum Elite status and fourth-night-free award stays.

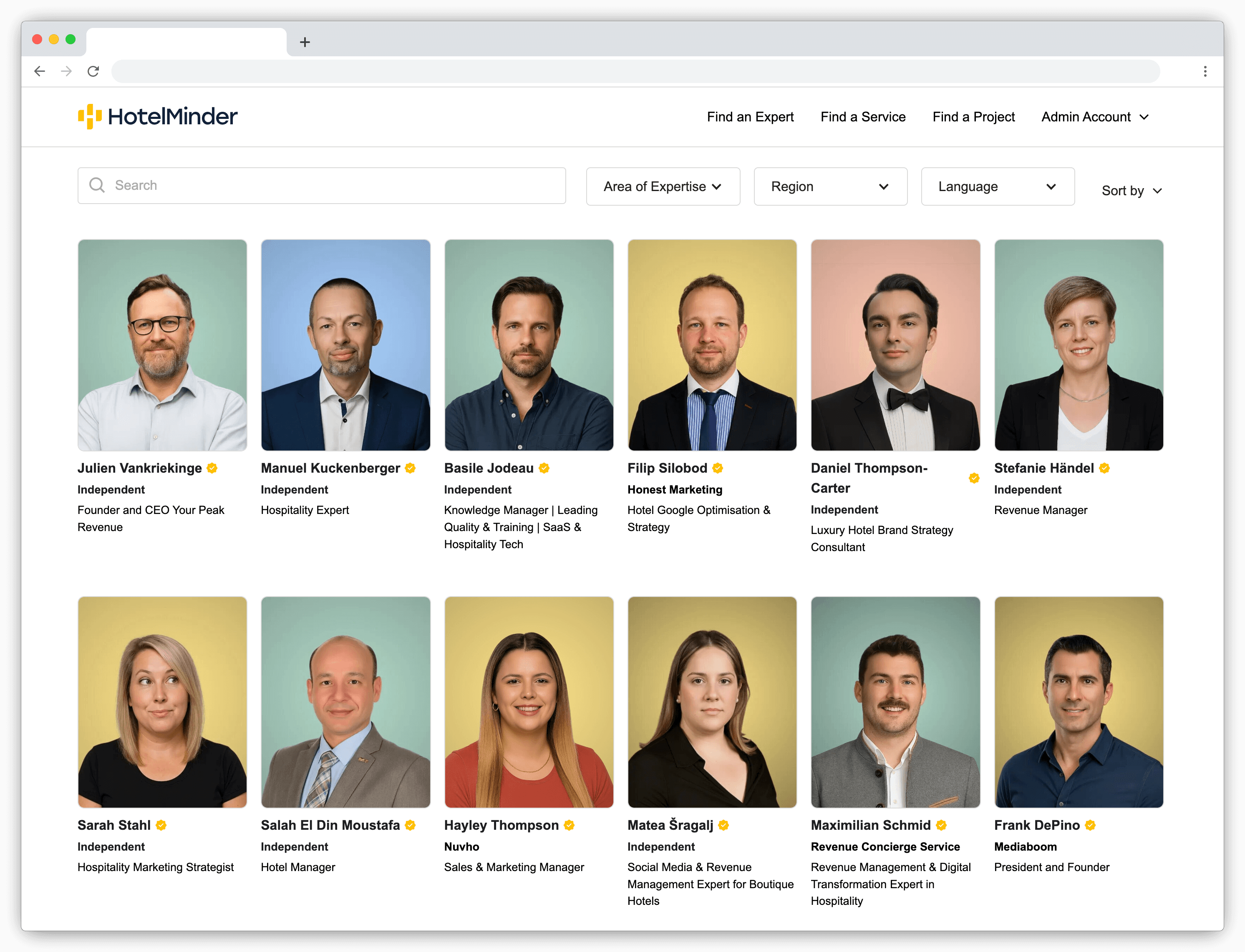

With HotelMinder, match with vetted hotel experts to solve your operational problems.

IHG’s portfolio comprises 20 distinct brands across five segments:

Garner, launched in 2023, surpassed 20 hotels by 2025, with debuts in Japan (e.g., Osaka) and Europe (e.g., Preston Samlesbury). Voco continues rapid growth with openings like voco Stockholm – Kista and voco Zeal Exeter. The Green Engage program, alongside the 2024 Low Carbon Pioneers initiative, promotes sustainability with energy-efficient, low-carbon hotels certified by standards like LEED.

Hyatt Hotels Corporation, based in Chicago and led by President and CEO Mark S. Hoplamazian, operates a more curated portfolio of over 1,350 properties in 79 countries as of early 2025. While smaller than its peers, Hyatt is a major force in the luxury, lifestyle, and resort segments.

Hyatt operates with a mix of managed, franchised, and a comparatively larger owned/leased portfolio than its rivals, though it continues to transition towards an asset-lighter base. The company's strategy is centered on serving the high-end traveler. The World of Hyatt program had approximately 46 million members at the end of 2024, confirming its strength as a growth driver.

A key part of its recent strategy has been the acquisition of asset-light platforms, such as the Apple Leisure Group (ALG), which instantly made Hyatt a global leader in luxury all-inclusive resorts.

Hyatt's portfolio of nearly 37 brands is organized into distinct collections:

Hyatt continues to integrate and expand its Inclusive Collection, tapping into the robust demand for all-inclusive travel. The acquisition of Dream Hotel Group further bolsters its lifestyle hotel presence in key urban markets. Sustainability is also a focus through its World of Care program.

Each brand employs distinct strategies to capture market share:

For travelers, brand choice impacts experience, pricing, and loyalty program value:

Marriott, Hilton, IHG, and Hyatt are global hospitality titans, leveraging asset-light strategies to expand their influence. Marriott leads in scale, Hilton in innovation, IHG in mainstream franchising, and Hyatt in luxury and lifestyle niches.

For hotel owners and investors, choosing a brand involves aligning with a global distribution network, loyalty program, and strategic vision. For travelers, brand differences shape experiences and rewards. As these giants navigate challenges like labor shortages, competition from short-term rentals, and geopolitical risks, their focus on sustainability, technology, and global expansion will shape the future of travel.

Swati is an accomplished content marketing specialist who focuses on developing valuable and practical content that addresses the concerns of hospitality businesses end-users.

HotelMinder brings value to hoteliers through a Knowledge Hub, a Technology Marketplace and one-to-one hotel management consulting services. With our 50+ years of combined expertise, we provide actionable solutions to critical business challenges, while establishing a relationship based on trust, engagement and mutual benefit. We help hotels meet and exceed their business goals through an in-depth analysis of consumer insights, business requirements and opportunities.

We are excited to announce the launch of Lobby, a brand-new network of hospitality consultants, which connects hospitality industry decision-makers with carefully vetted hospitality experts to deliver faster, more effective, actionable solutions to hoteliers’ top problems – launched to the public in October 2025.

If you are a hotelier who needs support, information or advice, or a hospitality industry expert who wants to help hoteliers achieve their business goals, you can enter the Lobby for free.

Your trust is our top priority. Whether you're choosing technology or connecting with an expert, we're committed to transparency. Here’s how we ensure you get unbiased, reliable guidance. Learn more about our promise.

Browse Knowledge Hub

Check out the latest insights, news and articles from the HotelMinder team, industry leading technology vendors and hospitality consultants.

Revenue Analytics and Jonas Chorum announce a two-way integration to automate hotel pricing, sync real-time data, and boost RevPAR with AI-powered insights.

Stop guessing your demand. Learn the simple 7-step guide to hotel forecasting to build reliable budgets, optimize your pricing, and take control of your revenue.

A hotel consultant debunks 3 common hotel technology myths. Learn why new tech isn't always the answer & how to truly optimize hotel operations for profit.

Access world-class hospitality expertise with Lobby. Our on-demand hotelier expert network offers proven solutions for revenue management, marketing, and technology challenges. Join free.

Discover more insightful articles in our Knowledge Hub and Partners Hub.

Sign up for expert insights, exclusive offers, and real solutions made for hoteliers like you.